Trustee Quality Unveiled: Leveraging the Experience of an Offshore Trustee

Wiki Article

Preserve Your Personal Privacy: Offshore Count On Providers and the Duty of an Offshore Trustee

Offshore trust fund services use people and companies a viable option to safeguard their properties and maintain discretion. By understanding the intricacies of offshore trusts, people can make educated choices about their monetary future. With overseas trust solutions, individuals can relax assured that their personal and financial info remains secure, permitting them to focus on their core objectives without compromising their personal privacy.Recognizing Offshore Trusts

Offshore counts on give people with a personal and safe way to handle and secure their possessions. These trust funds are lawful entities produced in a territory beyond the person's home nation, commonly in a tax obligation place. The main purpose of an overseas trust fund is to preserve and safeguard possessions privacy.

Additionally, offshore trusts can give property defense. By placing possessions right into a trust fund situated in a territory with solid asset security regulations, people can shield their wealth from prospective financial institutions, lawsuits, or various other lawful claims. This defense is especially valuable for high-net-worth individuals that may face boosted examination or greater threats in their home nation.

Offshore trust funds additionally offer tax benefits. Some territories have favorable tax laws that allow individuals to decrease their tax liabilities by establishing an offshore depend on. By using legal tax planning strategies, individuals can enhance their tax position and potentially lower their total tax concern.

Benefits of Offshore Trust Services

The benefits of utilizing offshore trust services expand past privacy and property protection. Offshore trust fund solutions provide a series of benefits that make them an attractive choice for individuals and services aiming to enhance their monetary affairs. One major benefit is the potential for tax obligation optimization. Offshore trust funds can be structured in such a way that enables for the lawful reduction of tax liabilities. By capitalizing on positive tax legislations and people, territories and organizations can reduce their tax obligation concern and preserve even more of their wealth.An additional benefit of overseas trust services is the versatility they supply in terms of estate planning. Offshore trusts can be utilized to hold and take care of assets on behalf of beneficiaries, ensuring a smooth transfer of riches upon the settlor's fatality. They can additionally provide a level of asset security, securing assets from potential lenders, claims, and various other lawful dangers.

Additionally, offshore trust services can give accessibility to global investment opportunities. By developing a rely on a jurisdiction that offers beneficial investment people, organizations and regulations can diversify their profiles and potentially accomplish higher returns.

Lastly, offshore trusts can supply privacy and confidentiality. Making use of offshore structures can aid secure an individual's personal and financial information from public analysis. This can be especially important for high-net-worth individuals that desire to maintain their monetary affairs exclusive.

Role of an Offshore Trustee

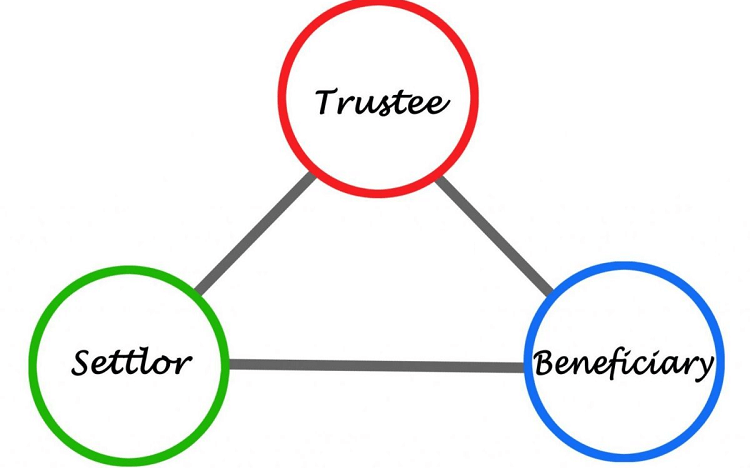

To efficiently carry out an offshore trust, the role of an overseas trustee is critical in taking care of and securing the possessions held within the trust. An overseas trustee is an expert or a company entity that is selected to act upon part of the beneficiaries of the trust. They play an essential function in ensuring that the trust fund is structured and handled according to the regulations and policies of the overseas jurisdiction.Among the key duties of an offshore trustee is to hold and take care of the possessions of the trust fund. This includes making financial investment decisions, managing monetary purchases, and making sure that the properties are secured and maintained for the benefit of the beneficiaries. The trustee should act in the very best interests of the beneficiaries and workout due persistance in the monitoring of the trust fund.

Along with property monitoring, an offshore trustee likewise plays an important role in keeping the personal privacy and confidentiality of the depend on (offshore trustee). They work as a shield between the recipients and the general public, guaranteeing that the details of the depend on, consisting of the beneficiaries' identifications and the properties held within, continue to be confidential and secured from spying eyes

Additionally, an offshore trustee is in charge of making certain compliance with the governing and lawful demands of the offshore territory. They need to stay updated with any kind of changes in the guidelines and legislations and make certain that the count on continues to be in conformity in all times.

Keeping Personal Privacy With Offshore Depends On

Keeping personal privacy is a vital element of utilizing offshore trust funds - offshore trustee. Offshore trusts offer my company a level of confidentiality and defense for people looking for to protect their properties and financial events. By developing an offshore trust, individuals can guarantee their economic details stays personal and shielded from spying eyes

Offshore territories typically have robust personal privacy legislations in location that restrict access to trust-related information. These territories prioritize the security of individual and economic data, making it hard for unauthorized celebrations to acquire accessibility. Some overseas jurisdictions may call for court orders or substantial evidence before revealing any get more kind of trust-related information, offering an added layer of personal privacy and security.

To even more boost privacy, individuals can select a professional overseas trustee to take care of the trust fund on their behalf. An offshore trustee acts as a fiduciary and is accountable for carrying out the count on in conformity with its terms and the applicable laws. By delegating the administration of the depend a specialist trustee, people can distance themselves from the trust's operations and maintain an extra layer of privacy.

Safeguarding Your Possessions With Offshore Counts On

One important facet of making use of offshore trusts is the implementation of efficient possession security approaches. Offshore depends on use an effective device for securing your assets versus numerous threats such as legal actions, financial institutions, and unpredictable political or financial conditions. By transferring your assets to an offshore trust fund, you can develop an added layer of defense that can aid secure your wide range from possible dangers.Among the main benefits of utilizing offshore trusts for property defense is the capability to separate legal ownership from valuable possession. By putting your assets right into the depend on, you properly move legal ownership to the trustee, that holds and handles the assets in your place. This separation can make it a lot more tough for possible plaintiffs to accessibility and confiscate your possessions, as they are no longer considered your individual residential or commercial property.

Along with property security, overseas depends on can likewise supply tax preparation benefits. Some jurisdictions may give beneficial tax obligation treatment for possessions kept in offshore trust funds, allowing you to reduce your tax obligation liability and protect even more of your wide range.

Final Thought

Finally, offshore count on services supply individuals the chance to maintain their privacy and secure their assets. By using the know-how of an overseas trustee, people can profit from the advantages of offshore counts on my explanation and preserve privacy. Offshore counts on offer a reliable and lawful methods of protecting one's wide range and making certain economic security.Unlike traditional onshore counts on, which need public disclosure of properties and beneficiaries, offshore trusts afford a higher degree of privacy.To effectively administer an overseas trust, the role of an offshore trustee is essential in handling and protecting the assets held within the trust fund. Unlike traditional trusts, offshore trusts do not call for the disclosure of recipients or settlors to the public. offshore trustee. By leaving the management of the count on to a professional trustee, people can distance themselves from the trust fund's procedures and preserve an additional layer of privacy

By using the experience of an overseas trustee, individuals can benefit from the benefits of offshore counts on and maintain discretion.

Report this wiki page